FAQ

Are all the news I see on investing traded?

No, only the major ones related to USD (USA)SEK (Sweden), Nok (Norway), Aud (Australia), Cad (Canada) and GPB (UK) the latter only when the difference is very consistent. In case of small differences is not traded, this is because of the Brexit situation which causes a lot of uncertainty around this currency.

Exotic currencies or currencies of particular, unstable countries are not traded. This is because of the instability of such countries that make risky (unpredictable) the trade or because of the lack of liquidity (few investors).

As it can be seen on investing each news comes with 1,2 o 3 images of bullheads next to it. The heads indicate the volatility that the output of this news could generate on the currency.

Only three-headed and two-headed news are traded if the difference is good (always and only in the scenario C described above). This is because one-headed news are less important events and therefore wouldn’t give the necessary push to the currency to do a safe trade. Let’s imagine that a positive news is released, this would make us assume that the currency will go up in relation to another currency. However, if the difference between Actual and Forecast is small, the system will not trade as the currency might initially go up but will then go down ,causing therefore a loss.

How much do you earn with this trading system?

This question cannot have a definitive answer as everything depends entirely on the market.

None has unfortunately the possibility of predict the future. Where there is a market in which the economic events (news) are “flat” few trades are made. Or in times of uncertainty few trades are no one, unfortunately, has the power to foresee the future. In the presence of a market where economic events (news) are ” flat ” few trades are made on the contrary a market with several deviations will generate many trades. Or at times of great uncertainty few trades are made (made an example is with the GBP considering the Brexit uncertainty)

Leverage Ratio

Let’s assume you have € 100,000 in a bank invested, with a risky management you would presumably have an annual profit of € 5,000 gross.

But what would happen if you had 10,000,000 invested? With the same management you would have a profit of € 500,000 .

The leverage ratio is a financial instrument that the broker makes available and which gives the opportunity to invest for much more of the capital at disposal. Therefore if without the leverage ratio for example you would earn 5 euros in a trade, with the leverage ratio 100:1 you will earn € 500.

This process is applied also in case of losses, however, in this case, the software acts very cautiously and only triggers the trade when is really worth it (see the 3 scenarios initially envisaged) and also when trade is triggered, the system proportionally invests in the actual difference of the news (if the difference is little the investement wil be little, if the difference is big the investment will be bigger).

Furthermore, for each trade, a stop loss is always set (the loss operation is closed after it reaches a certain limit).

According to the statistics, in a 50 months timeframe , only 2 months registered a loss (all the other years always registered great profits). One of the two months mentioned was on the GBP currency, when Britain’s decision to exit the European Union was announced (as said before, this is the reason why the system trades the GBP currency only when the difference is consistent and is really worth it)

The leverage ratio required to operate in sync with the software is at the least 100:1 .

How many trades can I expect per month?

This question can not be answered because everything depends solely on the market and the A/B/C scenarios mentioned above.

There could be 4 trades in a week or 5 in a month. The system trades only in scenario C,for prudence. By contrast, if the system was set to trade on an unlimited number of news it would be risky.

Are binary options traded?

Absolutely not. Binary options are equivalent to gambling. The system trades with awareness (if an economic event/news is extremely positive the currency will almost surely go up and it would be the same on the opposite case), binary options are instead a bet without foundations in order to make predictions.

I am not sure I understood: do I have to invest dollars or any other currency and hope that the value will go up?

No, no medium/long term investment is required. Only when a news will be released the system will then buy or sell. This will all happen in a matter of minutes.

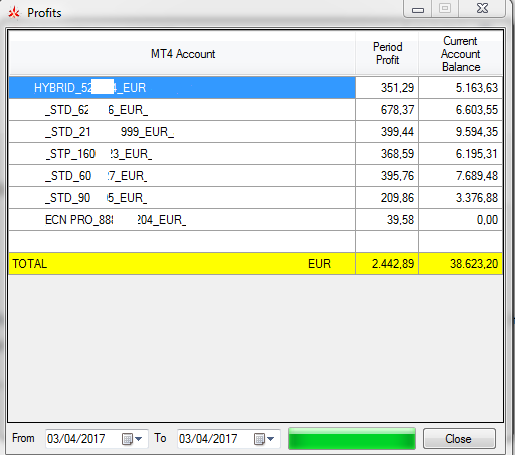

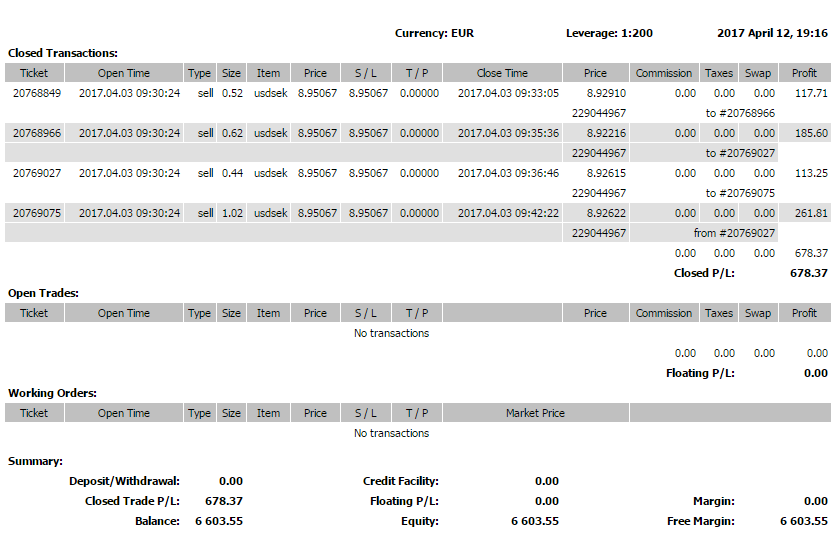

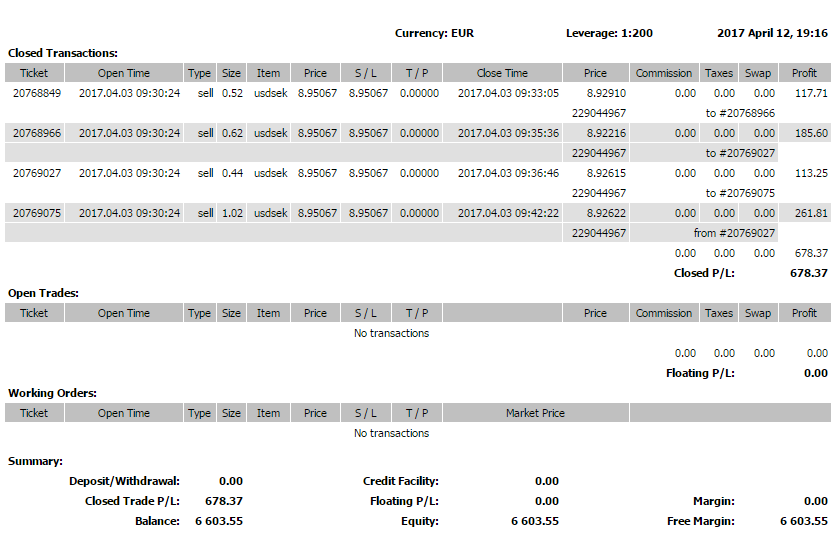

The image below shows an example with one of the broker connected to the software:

image b

image c

Do all trades generate profit?

On average 90% of the trades is positive. Some trades can generate minimum losses which are always promptly offset in the subsequent trades ( or in the same trade by other brokers ).

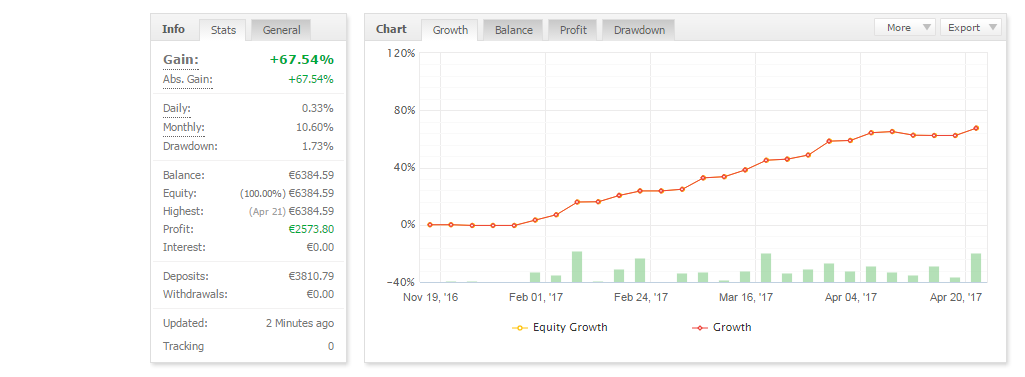

The following is an example of the trend of a single broker:

image d

Are trading skills needed?

No. However it is good to have a basic knowledge of english and to be a little practical with the computer.

Without any doubts knowing the dynamics of forex can help to have a better understanding ofthe process and to experience with more passion the moments in which the software generates profits.

Is the software used a Robot? (Aka EXPERT ADVISOR)?

No Robots (whether they are more or less valid) are programs that according to different factors ( i.e. statistical indicators) trade without a human intervention that modifies the characteristics according to the changes of the market.

We use in DEMO to test many robots: for a few months it can generate impressive profits but the evolution of the market doesn’t match the evolution of the robot, so big profits can quickly lead to big losses.

If at the same time for the same currency there is a positive and a negative news does the system trade?

No. The system doesn’t trade in this case.