Broker

What is a broker?

To operate in markets (of any kind), the individual needs a financial intermediary (eg banks) for him to buy/sell. The broker is therefore a financial intermediary licensed to perform such operations (authorized by authorities such as Cysec or FCA for example).

Which brokers to choose?

There are hundreds of brokers in the world, however they can be more or less valid.

Foreword: All brokers used are licensed and regulated.

Example: Let’s assume that we have a capital of 30,000 euros to invest The best solution is to open 10 brokers, 3,000 euros each.

Why not put all 30,000 euro on just one, maybe the best?

An example clarifies the reason:

With such asset (3,000 out of 10 brokers = 30,000 euros) when a news is released and the software transmits the trade to the brokers you will see that each of them will get a different profit.

This is because every broker at the time of the trade will make you a different price (due to various factors, i.e. liquidity, etc.). There are cases in which some brokers generate profits of perhaps 600 euros and others of 10 euros.In the subsequent trade the situation could turn over. This is the reason why we make sure there is diversification, to make sure there is always enough software brokers that maximize profit.

Brokers are tested daily and then used in person, so you always have the best possible brokers and you will be updated in real time.

If a broker did not work well anymore (it may happen that after some trade, they delay the execution of the operation by generating small losses) this will be closed and another will be opened, withdrawing the money from the first and transfer it to the second. The company itself controls the performance of the brokers. However due to the amount of customer accounts handled, is good practice that after each trade (if the returns of the above customers are discordant) every user sends us reports (a screen shot like the one below taken from the program) in order to verify the situation.

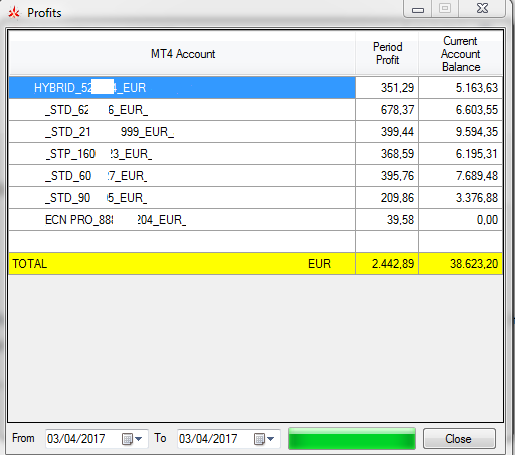

image B

Image B shows the result of a trade on 03.04. As you can see all brokers have made a good profit except the last one. The said broker not having registered sufficient profits for 2 and 3 times already (resulting sometimes in losses) and it has been removed and replaced with another one (in the ‘Current Account Balance’ item, in fact, the value is 0).

In addition to sending reports such as the ones shown above, is therefore very important to close and reopen brokers when the company will request it. This operation is very quick (it can take as little as 5 minutes).

The documents that will be required (anti-money laundering) for opening brokers will be an identity document and a bill, a bank statement etc. as proof of residence (the address must be shown). These are the same documents that a payment system such as PayPal may require when exceeding 2500 Euros of annual purchases.

You will then withdraw the balance from the old broker (the transaction is called ”Whitdrawal”) and you will transfer to the new broker.

The exceptional aspect of this trading system is linked also to the use/update of the brokers.

Can I pick any broker and possibly use my broker?

It is possible to use any broker but strongly advised to use only those indicated It is important to note that the software managers test daily different brokers indicating the ones who have the best returns.

It is therefore strongly advisable to use only those recommended for the best return at the time of the trade.