The system adopted trades the main news that occur daily, such as unemployment rate, oil stocks and interest rates, to name a few examples.

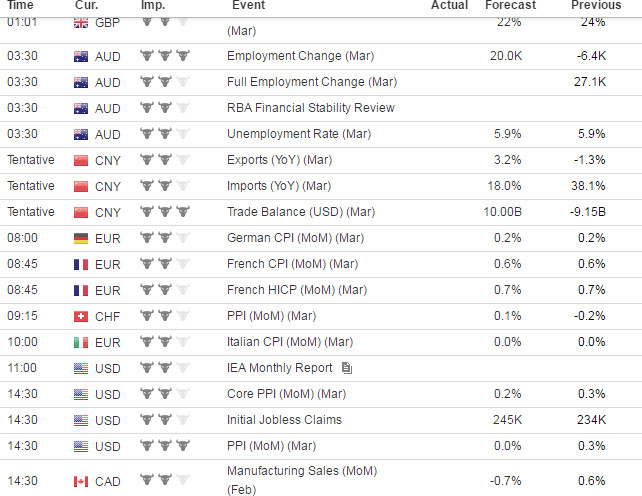

These news are economic events that are published at set times, below is an example from https://www.investing.com/economic-calendar/ (relevant reference site).

Such events make a currency gaining or losing value to another.

Image A

We can refer to the 2.30 pm news:

U.S. Core Producer Price Index (PPI) MoM

The Core Producer Price Index (PPI) measures the change in the selling price of goods and services sold by producers, excluding food and energy. The PPI measures price change from the perspective of the seller. When producers pay more for goods and services, they are more likely to pass the higher costs to the consumer, so PPI is thought to be a leading indicator of consumer inflation.

3 different fields can be noticed:

1)Previous=(this is the value that is presented as current before the new data is released at 2:30 pm)

2) Forecast= (this is the value that analysts predict)

3) Actual (this value is not shown before the news is released)= this is the value that will be released at 2.30. pm

At 2.30 pm on the website investing (but also on similar web portals) the new value ACTUAL will be released and a few scenarios will be available:

- Scenario a) The value Actual is equal to the Forecast value. This means that analysts have made a correct prediction and the system will not trade. In fact, since this value has already been provided, there is no surprise effect and the currency in question will not rise/fall compared to its counterpart (dollar against the Japanese yen for example) sufficiently enough to allow a secure trade. It would be risky and unconscious to trade in this case (cause unpredictability).

Currency trading is always done in currency pairs (Currency Pairs). For example, if USD/JPY is traded, the dollar buys and sells Yen (or vice versa). - Scenario b) The Actual value is different from the Forecast but the difference is small. It is good toremember that ”small” is a relative concept and changes from news to news: a specific interest rate can trigger the trade with 0.25% variation (the most important trading are the interest rates) while for other news the trade might not occur. The system will not trade if the scenario B occurs.

- Scenario c) The value Actual is different from the Forecast one and the difference is consistent (this is again a relative concept). In this case, a trade is triggered. The system will then either buy or sell if the news is positive or negative.

Example on the pair USD/JPY in the scenario C:

In case any news expresses, in the second when the data is released (Actual), a positive figure for the dollar the trade will be triggered as the dollar will gain value against the Yen. Long positions (buy) will then be opened and dollars will be purchased that will be resold automatically at the end of the trade generating profits (buy x and resell to x + y). This process will all happen in a few seconds/minutes.

In case any news expresses, in the second when the data is release (Actual), a negative figure for the dollar the trade will be triggered in that case too and short (sell) positions will be opened.

Dollars will then be sold at an x price and rebought at an x-y price.

This will only happen if at the same time and for the same currency there is no news whose data goes in the opposite direction (negative and positive news at the same time).

In both cases, operations will end in profit.

Depending on how incisive the difference between Actual and Forecast is, the system will decide how much to invest (how many lots to use). With small differences the system will trade more cautiously (this is because the currency is expected to rise or fall shortly) while with more consistent deviations the system will enter more heavily in trade (greater gains).

For every trade a stop loss is always set (if the operation was in loss it would be closed, when reaching a certain limit)

What is this system?

The system is a software created by an agency of analysts and informatics which transmits selling/buying signs to your brokers.

Which brokers to choose?

There are hundreds of brokers in the world, however they can be more or less valid.

Do all trades generate profit?

On average 90% of the trades is positive. Some trades can generate minimum losses which are always promptly offset in the subsequent trades (or in the same trade by other brokers).

LIQUIDITY PROVIDERS